Amur Capital Management Corporation for Dummies

Amur Capital Management Corporation for Dummies

Blog Article

Unknown Facts About Amur Capital Management Corporation

Table of ContentsThe Definitive Guide for Amur Capital Management CorporationThe Facts About Amur Capital Management Corporation UncoveredLittle Known Facts About Amur Capital Management Corporation.The Best Guide To Amur Capital Management CorporationThe Definitive Guide to Amur Capital Management CorporationAmur Capital Management Corporation Fundamentals Explained

The firms we adhere to require a solid track record commonly a minimum of 10 years of operating background. This indicates that the firm is most likely to have faced a minimum of one economic recession which management has experience with adversity in addition to success. We look for to leave out companies that have a credit score high quality below investment quality and weak nancial toughness.A firm's capability to raise returns consistently can demonstrate protability. Firms that have excess cash ow and solid nancial positions frequently choose to pay dividends to draw in and reward their shareholders. Consequently, they're usually less volatile than supplies that don't pay rewards. Beware of reaching for high returns.

The Best Strategy To Use For Amur Capital Management Corporation

Diversifying your financial investment portfolio can aid shield against market uctuation. Look at the size of a company (or its market capitalization) and its geographical market United state, industrialized international or emerging market.

Regardless of just how very easy digital financial investment monitoring platforms have made investing, it shouldn't be something you do on a whim. If you make a decision to get in the investing globe, one point to consider is just how long you in fact desire to invest for, and whether you're prepared to be in it for the lengthy haul - http://peterjackson.mee.nu/do_you_ever_have_a_dream#c2017.

As a matter of fact, there's an expression typical connected with investing which goes something along the lines of: 'the round may drop, but you'll intend to make sure you're there for the bounce'. Market volatility, when financial markets are fluctuating, is a common sensation, and long-lasting can be something to help ravel market bumps.

Some Known Details About Amur Capital Management Corporation

With that in mind, having a long-term approach could assist you to benefit from the wonders of substance returns. Joe invests 10,000 and earns 5% reward on this investment. In year one, Joe makes 500, which is repaid right into his fund. In year 2, Joe makes a return of 525, since not only has he made a return on his first 10,000, yet also on the 500 invested dividend he has actually gained in the previous year.

Amur Capital Management Corporation for Beginners

One means you might do this is by securing a Supplies and Shares ISA. With a Stocks and Shares ISA. mortgage investment, you can invest approximately 20,000 per year in 2024/25 (though this is subject to alter in future years), and you do not pay tax obligation on any type of returns you make

Beginning with an ISA is actually simple. With robo-investing systems, like Wealthify, the effort is done for you and all you need to do is pick just how much to spend and choose the threat level that matches you. It may be among minority instances in life where a less psychological approach could be advantageous, but when it pertains to your finances, you might intend to pay attention to you head and not your heart.

Staying focussed on your long-term objectives could assist you to stay clear of irrational choices based on your emotions at the time of a market dip. The tax treatment depends on your individual scenarios and might be subject to change in the future.

The Ultimate Guide To Amur Capital Management Corporation

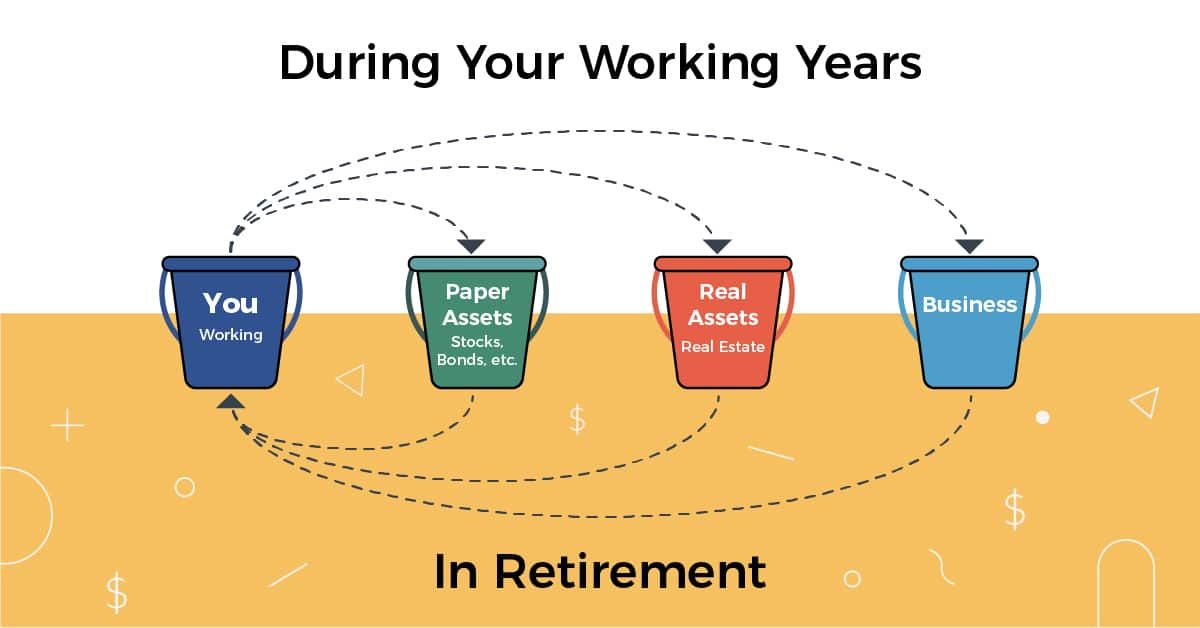

Nevertheless investing goes one step better, assisting you achieve individual objectives with 3 considerable benefits. While saving means alloting part of today's money for tomorrow, spending ways placing your cash to function to potentially gain a better return over the longer term browse this site - capital management. https://wool-savory-367.notion.site/Unlocking-Financial-Potential-A-Deep-Dive-into-Amur-Capital-Management-Corporation-ba0cce12499f41aabdb2c43fc54e642c?pvs=4. Different courses of financial investment possessions money, dealt with interest, building and shares normally create various levels of return (which is family member to the threat of the investment)

As you can see 'Development' assets, such as shares and residential or commercial property, have actually historically had the very best general returns of all asset courses however have actually likewise had larger tops and troughs. As an investor, there is the prospective to earn capital development over the longer term in addition to a recurring earnings return (like dividends from shares or rent out from a residential or commercial property).

The 5-Second Trick For Amur Capital Management Corporation

Rising cost of living is the recurring rise in the expense of living gradually, and it can influence on our financial wellness. One means to assist surpass rising cost of living - and produce positive 'real' returns over the longer term - is by spending in possessions that are not simply with the ability of delivering greater income returns yet likewise provide the capacity for capital development.

Report this page